24 Questions to Ask When Deciding Whether to Buy, Lease, or Rent a Semi Truck or Trailer

This Guide answers to most common questions customers ask about heavy duty truck and trailer buying, leasing, or renting—and also includes questions they should be asking.

-

Jordan Harvey

Director - Lease & Rentals Sales -

Kevin Bowen

National Truck Sales Manager -

Kurt Pepper

National Trailer Sales Manager -

Andy Haugen

National Rental Sales Manager

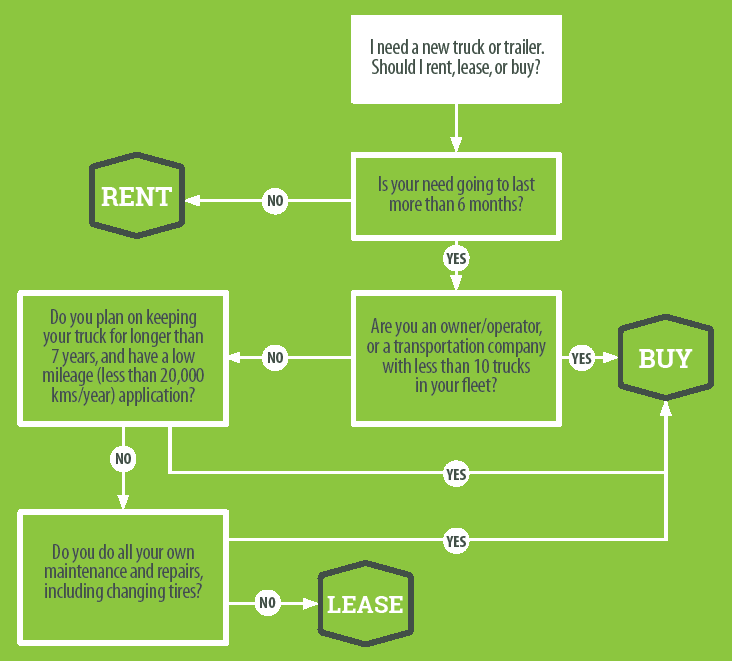

Shoud You Buy, Lease, or Rent a Heavy Duty Truck or Trailer?

Click on the video above for a quick summary of what you'll find on this page

You Have Options

For most of our customers, transporting their goods --whether that is food or fertilizer -- is secondary to what their business is all about.

Our advice to you is to question your current model. Just because things have always been done a certain way, doesn’t mean business as usual works best for your current operations.

You can choose to outsource all of your transportation needs to a third party. You can even get your decals and logo placed on the third party equipment so you benefit from branding. In this option, you free yourself from the headaches of dealing with equipment and drivers but the price would be your most expensive option.

For many businesses, the expense and loss of control of completely outsourcing transportation has them looking at other options. Should you buy, lease or rent?

Deciding whether to rent, lease, or purchase is not easy. There are many factors at play, such as your business size, the hours and kms your equipment gets used, the duration of your need, your own in-house truck and trailer service capabilities, and whether or not you wish to use cash on hand for a down payment. These are just a few of the things to think about in your decision-making process.

Start by determining the real costs of your businesses transportation costs. And we mean all costs. Our experience shows that approximately 75% of small to medium sized businesses do not have a good handle on their costs. Without a baseline of your true costs, it’s very difficult to make the best decision for your business.

At Maxim, we want to give you the tools and information you need to make the best decisions for your operation. Whether you decide to purchase, lease, or rent, we have a Canada-wide team that can provide you with the best solution to suit your needs.

Top 5 Reasons to Buy, Lease or Rent

You should BUY if:

• You are an Owner/Operator who makes a living at trucking.

• You are a smaller fleet (less than 10 trucks) dedicated to trucking.

• Your operation keeps trucks for longer than seven years.

• Your equipment travels under 20,000 kms /year.

• Your operation has maintenance and repair facilities and you wish to do this work in-house.

You should LEASE if:

• You are not in the trucking business and wish to focus on your core competence, not transportation.

• You do not have—or wish to have—maintenance or repair facilities.

• Your equipment travels more than 20,000 kms/year.

• Your image is important and you need late model equipment that better reflects your brand.

• You don’t want the burden of vehicle maintenance and regulatory requirements.

You should RENT if:

• Your need is going to last 6 months or less (definitely not longer than 12 months)

• You operate in a seasonal or cyclical business with spikes during peak months

• You have regular equipment that is out of commission or broken down

• You are waiting for new equipment to arrive from the factory

• You are trying a new run with equipment you may not have in your fleet but might consider in the future

| FREQUENTLY ASKED QUESTIONS AND ANSWERS TO BUYING, LEASING OR RENTING | |

| 1 | What should my transportation provider ask about my operation? The time of deliveries is a good place to start. If you only deliver during the day, is there potential that you could also deliver at night? Some trucks could be double-shifted to get some synergies. Also, if they know when your trucks are idle, it’s easier to schedule maintenance. You don’t maintain them from 9 a.m. to 5 p.m. on Monday to Friday. That’s when they’re being used. |

| 2 | How much thought typically goes into determining the transportation needs of a company? A lot of the time the responsibility for transportation gets shifted from person to person. When asked why it’s being done a certain way, they’ll say, “We’ve always done it that way,” which obviously doesn’t mean it’s the best way of doing it. |

| 3 | Where should I start with assessing my transportation cost structure? We mostly recommend using a cost per kilometer assessment. Using true kilometers allows you to know your costs. You don’t want to look at the fixed cost per truck per month because that can be a false number. Some companies make decisions on the monthly number. There are hidden costs with this metric (i.e. travel time, kms and fuel to deliver a truck to maintenance providers not readily accessible or that don’t offer maintenance in the client’s yard). In addition, the operating costs are the most important metric to measure. Those include the cost of the equipment, driver costs, fuel and maintenance. While equipment costs may be $0.13/Km, your operating costs might be more like $1.00/Km so just focusing on equipment costs will mean losing sight of over 85% of your true transportation costs. Partnering with a transportation expert can help you make an accurate account of your costs and get a really clear picture of your true cost structure. |

| 4 | What criteria do most firms use in choosing a service provider? A lot of them would choose monthly fixed cost, rather than number of service locations, response time, service levels, the proximity to your locations and after-hours service. We have mobile trucks that can go out and change oil in your yard without spilling a drop on the ground. We can do it on weekends or whenever the truck is available. Lower up-front costs usually end up costing you more in the long run. |

| 5 | Are there benefits to working with a full-line, single-brand dealer? Yes. Just as you specialize in a small set of products or services to be successful, a truck dealer is going to work best for you if their sales, service, and parts department are able to focus on one main line or brand. While variety can be good, too much inconsistency can lead to sub-optimal support for your business. |

| BUYING | |

| 1 | Who is an ideal candidate for purchasing/financing? If you are an owner/operator, financing is a very good fit for you. Also, any transportation company with a fleet of less than ten or so trucks will usually benefit most from purchasing their vehicles. |

| 2 | What factors go into determining the specifications of transportation equipment? Unlike the auto industry where the main differentiation between vehicles is color and trim levels, most transportation vehicles are very, very unique. The application is the biggest determining factor when it comes to many of the specs including engine, axles and suspension. The more a dealer knows about your business and how you operate, the more likely it is that you’ll get equipment that doesn’t underperform or get equipment that is more costly than it needs to be. |

| 3 | What are the benefits to financing at a dealership versus a bank? Financing at a dealership can often mean less work for the customer than going to their own bank or financial institution. A dealership’s finance manager will orchestrate the necessary paperwork to structure the best financing to fit your needs. Every customer is unique and so are their financing requirements. Ideally, your lease or loan will be tailored to fit your needs. |

| 4 | How much money do I need to put down as a down payment? The industry standard is 10% of the purchase price. The finance manager will work with you and your credit profile to find the best combination so you qualify for an approval and for a payment that works within your budget. |

| 5 | What if I’m doing my own maintenance? Generally speaking, full vehicle maintenance can be very costly when done in-house, as the tooling required is expensive due to newer technologies. Even if you have facilities for basic maintenance like oil changes, your overall maintenance costs will almost always be lower if you outsource to an expert. And, a full maintenance lease will guarantee your costs based on the consumer price index rate. Finance contracts can also have maintenance packages included, and with an extended warranty you can ensure you’re fully covered in any case. |

| 6 | Are there savings opportunities that can come from the peaks and valleys in a delivery system? Yes. If your summer is slower, for example, you may have extra trucks in your fleet that you don’t need. You could have a core number of trucks; say five full-time, and two rentals that you could use for six months of the year. That can save quite a bit of money. The per-truck savings would be about $15,000. |

| 7 | What’s the difference between a lease and a loan? In a lease, the lender owns the equipment until the purchase option is exercised, and you are responsible to pay your taxes monthly on each payment. With a loan, you are the owner of the equipment, and the taxes are included in the financing. It is almost always best practice to speak with your accountant to determine which type of financing has the most tax benefits for you and your company. Credit criteria for a loan or a lease are the same. |

| LEASING | |

| 1 | What are the benefits of leasing a semi-truck? There can be many. For one, by dealing with a transportation expert, you can tap into their expertise for many money-saving measures, such as the optimal fleet size of both the truck and the engine that powers it. Lease providers should have strict maintenance requirements so the equipment is running at peak efficiency. When the lease is up, simply bring it back and lease a new truck. |

| 2 | What are the benefits of partnering with a lease provider? It’s very difficult to do multiple things well. Companies have expertise in their core business but they can’t know the transportation field as well as a company in that area. Handling your own transportation needs when it’s not your core business can lead to extra costs. |

| 3 | How will leasing instead of purchasing affect my cash flow? If you could make the choice to invest $20,000 into inventory production and other much needed items for your business, wouldn’t you want to? Leasing frees up your cash flow because it does not require a down payment. It leaves more of your assets liquid, resulting in greater flexibility for you as an owner/manager. |

| 4 | Isn’t a truck or trailer a valuable asset to own? Unless you require owned physical assets for tax write-off purposes, your return on investment on the cash you save by leasing is very likely to be greater than the value of owning your own truck. With maintenance, resale, and other ownership costs considered, you are better to invest elsewhere in your business, where cash is more needed. |

| 5 | What is a finance lease? A finance lease has a few uses, but one of the most common uses is for someone who is buying out the residual on their lease. We can essentially keep their payments the same until the duration of the equipment’s value has been paid. It can be created as a full maintenance lease, based on expected service requirements. That way, you get the reliable payments of a lease while you work towards ownership. No unexpected service bills. |

| 6 | What is the shortest-term lease I should enter an agreement for? In order for both parties to get the best value over time, a minimum of three years is recommended for a lease. There are a few cases where a shorter lease is applicable, but generally the lessee won’t get the full benefit of the agreement on such a short term. Leases can be drawn up for as long as seven-year agreements. |

| 7 | What financing mechanisms can be used to lease a truck? If you’re using a financing company or your bank, you usually have to come up with 10 to 15 per cent of the capital cost of the piece of equipment as a down payment. With leasing, you don’t need that. You’ll often just need the first and last month’s payments. That’s money you could put into your business, through inventory, buildings, or revenue generating personnel, as opposed to trucks which depreciate in value. |

| 8 | What options does a company have when deciding to move from owning its own vehicles to leasing them? Companies that own equipment are tasked with selling the equipment when it’s at the end of its useful life, which isn’t their core business. Depending on your equipment, your lease provider may buy them out and replace them with leased units. Selling a truck isn’t an easy task. In some instances there are warranties that have to be provided, not to mention the difficult task of actually selling the truck. For example when you park it on your front lot with a ‘For Sale’ sign on it, somebody has to show it to a potential customer and possibly ensure that the equipment conforms to DOT requirements, etc…Sounds like a used truck center! |

| RENTING | |

| 1 | What solutions are there for my wait-time on factory order equipment? Factory ordering is immensely common, and can take months. In the meantime, you still need to stay up and running. Rentals are an excellent way to bridge the gap. They can be set up for as little as a day, or as long as a year. Renting gives you the most flexible way to manage your trucks, trailers and equipment. |

| 2 | Who is a candidate for renting? Commercial vehicle renting is unique from personal rentals. You wouldn’t seek out a commercial rental vehicle for a weekend move for example. Commercial vehicle rentals tend to be longer in duration and more frequent. Commercial rentals also require a customer account setup prior to rental which includes a credit check. This generally takes 24-48 hours. It’s a good idea to get an account set up with your rental provider in advance, so there are no delays when you find yourself urgently in need of a rental vehicle. |

| 3 | When is renting a good option? Every case is unique, but generally, a rental is great for when you have a spike in your operations. Renting is ideal for seasonal businesses to get through periods where you need additional coverage, or for when a vehicle is unexpectedly out of commission. If your need is longer-term than a year, then a lease is often a more sustainable choice. |

| 4 | What is a low-risk alternative to financing or leasing for short term business agreements? Renting is a good way to test out a type of equipment for your business. If you don’t have a long term contract for a particular client with special requirements, or aren’t sure if a certain type of service will work for your company, renting keeps your risk low. For example, you might have a fleet of dry vans, and a customer asks you to ship something refrigerated. Rather than purchasing a reefer van for a single customer with no long-term commitments, a rental will let you trial reefer van runs to see if it’s a good fit in your operation. |